The technology sector recently experienced turbulence as the Nasdaq Golden Dragon China Index dropped significantly. This dip highlights renewed concerns among investors about market stability, particularly within Chinese tech companies listed in the U.S. Adding to this financial unease, reports surfaced that Meta Platforms Inc. had previously explored using censorship tools to re-enter the Chinese market. This has sparked fresh ethical debates around the use of AI in global digital privacy and surveillance.

The Nasdaq Golden Dragon Index: What the Drop Means

The Nasdaq Golden Dragon China Index, which tracks Chinese technology stocks listed in the U.S., fell sharply amid broader concerns about global economic stability and political developments. The index’s decline is a reflection of investor uncertainty regarding China’s regulatory environment and the long-term viability of tech companies operating under tight state control.

This drop is more than just a number. It reflects the growing sensitivity of global investors to any shifts in policy, trade relations, or government oversight. While U.S. tech giants have also shown volatility, Chinese companies remain more vulnerable due to stricter oversight by the Chinese government and concerns about data security.

Investors are closely watching how companies like Alibaba, JD.com, and Baidu respond to ongoing scrutiny. With growing concerns about AI regulation and digital freedom, this decline is seen as a signal that more turbulence could be ahead for the sector.

Meta’s China Dilemma: Censorship Tools Raise Privacy Questions

One of the most controversial revelations recently came from Meta, the parent company of Facebook and Instagram. Reports suggest that the company had considered developing censorship tools to gain access to the Chinese market. Although Meta never officially launched in China, the idea that it entertained compromising on AI-driven content moderation raises serious ethical concerns.

China is known for its rigid control over digital content. If Meta had moved forward with censorship tools, it could have meant customizing its algorithms to block specific topics, keywords, or viewpoints—potentially contributing to the suppression of free speech. This issue hits at the core of a larger debate: Should technology companies alter their ethical standards to gain market access in countries with restricted freedoms?

This conversation is increasingly relevant as AI technologies are being integrated more deeply into content filtering, facial recognition, and surveillance systems. The situation also underscores the role of big tech in balancing profit motives with global ethical standards.

For more on Meta’s ethical considerations and AI use, you can refer to this in-depth article by Reuters.

The Role of AI in Privacy and Global Politics

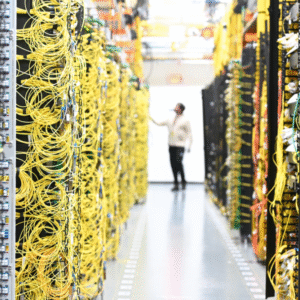

The conversation around AI and privacy in international markets is not new, but it’s gaining renewed urgency. As more companies expand globally, the pressure to comply with different digital policies becomes stronger. This often includes adjusting AI tools to match local laws, even if those laws are at odds with principles of transparency and free expression.

China, for example, enforces tight internet controls through its so-called “Great Firewall,” and foreign companies are often asked to comply with its censorship standards. Meta’s reported exploration of censorship tools, even if never implemented, shows how companies may be willing to bend their values under pressure.

This situation forces a question that governments, tech leaders, and consumers alike must answer: How can companies ensure that AI remains a tool for empowerment rather than control? The growing concern is that without international standards, AI could be weaponized for surveillance, manipulation, or worse.

To understand more about how AI is affecting privacy worldwide, visit The Electronic Frontier Foundation (EFF).

Market Volatility and Investor Outlook

The recent decline in the Nasdaq Golden Dragon China Index sends a message to investors: market volatility is far from over, especially in the tech sector. With political uncertainty, trade disputes, and ethical controversies swirling, the global tech market is walking a tightrope.

In particular, concerns about AI’s role in surveillance and data privacy are influencing how investors value certain companies. Ethical practices are becoming a key part of long-term investment decisions. Investors are no longer just looking at profitability but also at how companies navigate complex global standards and expectations.

This shift could encourage more transparency from companies, pushing them to disclose how their AI tools are used and how they handle censorship or data requests from authoritarian governments.

For a breakdown of how ethical tech influences investment trends, check out this Harvard Business Review article.

Final Thoughts: A Crossroads for Tech and Ethics

Tech companies today face an important choice: stay true to democratic values or make ethical compromises to expand into more restricted markets. The recent dip in the Nasdaq Golden Dragon Index and the ethical debate surrounding Meta are reminders that the intersection of business, ethics, and technology is more relevant than ever.

As AI continues to evolve, the responsibility of tech companies grows. They must not only innovate but also uphold ethical standards that protect individual privacy and freedom—regardless of geography.