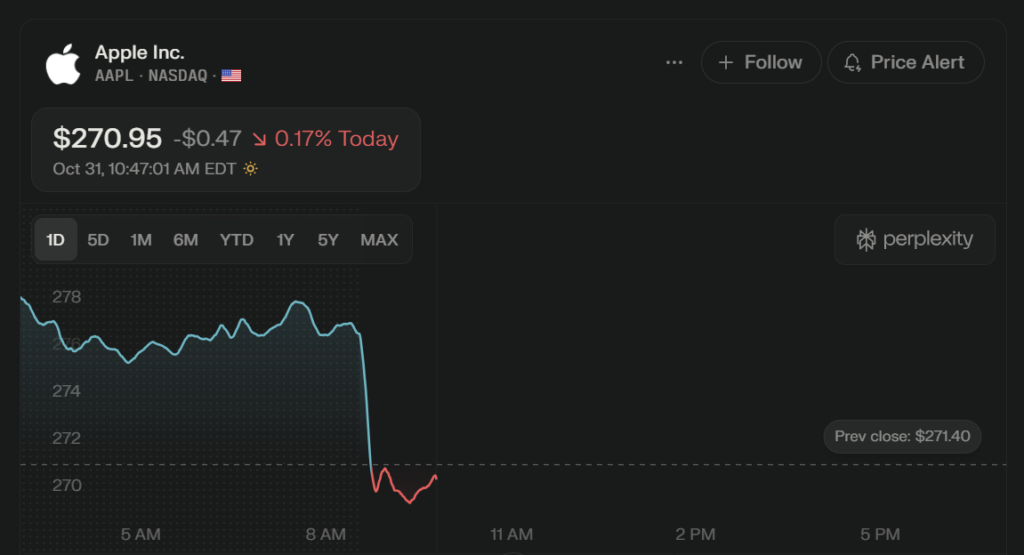

AAPL stock is once again making headlines as Apple Inc. continues to prove its dominance in the global tech market. Trading at around $270.92 on the NASDAQ, AAPL stock saw a minor dip of about 0.18% ($0.48) from its previous close of $271.40. The day’s trading range hovered between $269.16 and $277.32, which also marks the year’s high for Apple shares. With a staggering market cap of $4.02 trillion, Apple remains the world’s most valuable public company.

Strong Fundamentals Driving AAPL Stock

Apple’s price-to-earnings (P/E) ratio currently stands at around 36.27, and its earnings per share (EPS) sit at $7.47. The trading volume was roughly 29.13 million shares, which is slightly below its average of 54.58 million.

These figures show that AAPL stock remains highly liquid and continues to attract institutional investors due to Apple’s strong financial foundation and consistent performance.

Apple’s Q4 2025 Results Impress Wall Street

Apple’s fiscal fourth-quarter report (September 2025) revealed record-breaking performance, fueled by the new iPhone 17 lineup. iPhone sales surged 6% year-over-year, with expectations for 10–12% growth in the December quarter as more customers upgrade their devices.

The company also crossed $100 billion in annual services revenue — a major milestone. This growth in services, including iCloud, Apple Music, and the App Store, plays a big role in supporting AAPL stock stability, even during slower hardware cycles.

Wall Street analysts reacted positively. Argus Research raised its AAPL stock price target to $325 from $280, maintaining a Buy rating. Wedbush analyst Daniel Ives called Apple’s quarter a “pound-the-table moment” for investors, emphasizing how Apple’s growing investments in artificial intelligence (AI) and media strengthen its long-term prospects.

Future Outlook: AI, Media, and iPhone 17 Upgrades

Looking ahead, AAPL stock seems positioned for sustained growth driven by three powerful trends:

- Strong product cycle – The iPhone 17 continues to draw strong demand, and the upgrade momentum is likely to accelerate in the holiday season.

- Services expansion – Apple’s high-margin digital services business, now above $100B annually, provides recurring revenue that supports AAPL stock stability.

- AI and new media – Apple’s push into AI-powered devices, and its growing footprint in sports and entertainment through Apple TV+, signal new revenue streams for the years ahead.

Risks and Market Watch

Despite the optimism, AAPL stock faces a few challenges. Global supply chain dependencies, competitive pressure from Samsung and Google, and high market expectations could introduce volatility. Analysts note that while Apple’s fundamentals are strong, investors should watch short-term corrections as opportunities to accumulate more shares.

In Summary

AAPL stock remains near its 52-week high, supported by strong quarterly results, upbeat analyst sentiment, and Apple’s expanding ecosystem of devices and services. The company’s focus on AI innovation, iPhone upgrades, and services diversification continues to drive investor confidence. With a solid outlook heading into 2026, AAPL stock appears well-positioned to sustain its upward momentum in both performance and investor appeal.

Reference Links

- Apple Stock Target Raised to $325 on Strong Q4 Performance – AskTraders

- Apple’s Price Target Raised Amid AI iPhone Optimism – Markets BusinessInsider

- What to Expect from Apple’s Q4 2025 Financials – AppleInsider